Life insurance is an essential part of financial planning, offering protection and peace of mind for individuals and families alike. It provides a financial cushion for your loved ones in case something happens to you, ensuring they can maintain their standard of living and handle any financial burdens that may arise. Whether you are a young adult just starting your career, a parent looking to safeguard your family’s future, or a retiree wanting to leave a legacy, life insurance is a crucial tool in securing your financial legacy.

But how do you choose the right policy? What are the benefits of starting early, and how can you ensure your loved ones are fully protected? This guide will walk you through everything you need to know about life insurance, from why it matters to the different types of policies available and even tips on how to make sure you’re getting the best coverage for your needs.

What is Life Insurance?

At its core, life insurance is a contract between you (the policyholder) and an insurance company. In exchange for regular premium payments, the insurance company agrees to pay a sum of money—known as a death benefit—to your designated beneficiaries upon your passing. This death benefit can be used to cover various expenses, such as funeral costs, outstanding debts, daily living expenses, or even future financial goals like college tuition for your children or your partner’s retirement planning.

Life insurance comes in many forms, and choosing the right one depends on several factors like your financial situation, long-term goals, and the needs of your dependents.

Why Life Insurance Matters

Life insurance offers more than just financial protection. It’s a safety net that allows your loved ones to focus on grieving without worrying about the financial aftermath of your passing. The death benefit can prevent your family from selling assets or downgrading their lifestyle. It can also serve as an inheritance, allowing you to leave behind a financial legacy that supports your children, spouse, or even a charitable cause close to your heart.

Here are some key reasons why life insurance is a must-have

- Income Replacement: If you are the primary breadwinner, your family depends on your income for their daily needs. Life insurance ensures that, even if something happens to you, your income can be replaced, allowing your family to continue paying bills and maintaining their lifestyle.

- Debt Protection: If you have a mortgage, car loan, or credit card debt, life insurance can help pay off those obligations so your loved ones won’t have to shoulder that burden.

- Final Expenses: Funerals can be expensive, with the average cost often exceeding $10,000. Life insurance can cover funeral and burial costs, relieving your family of the financial strain during an already difficult time.

- Childcare and Education: Raising children is expensive, and life insurance can ensure your children are cared for financially, providing for their day-to-day needs and future education expenses.

- Estate Planning: For those with larger estates, life insurance can help offset estate taxes, ensuring that more of your assets go to your beneficiaries rather than toward paying taxes.

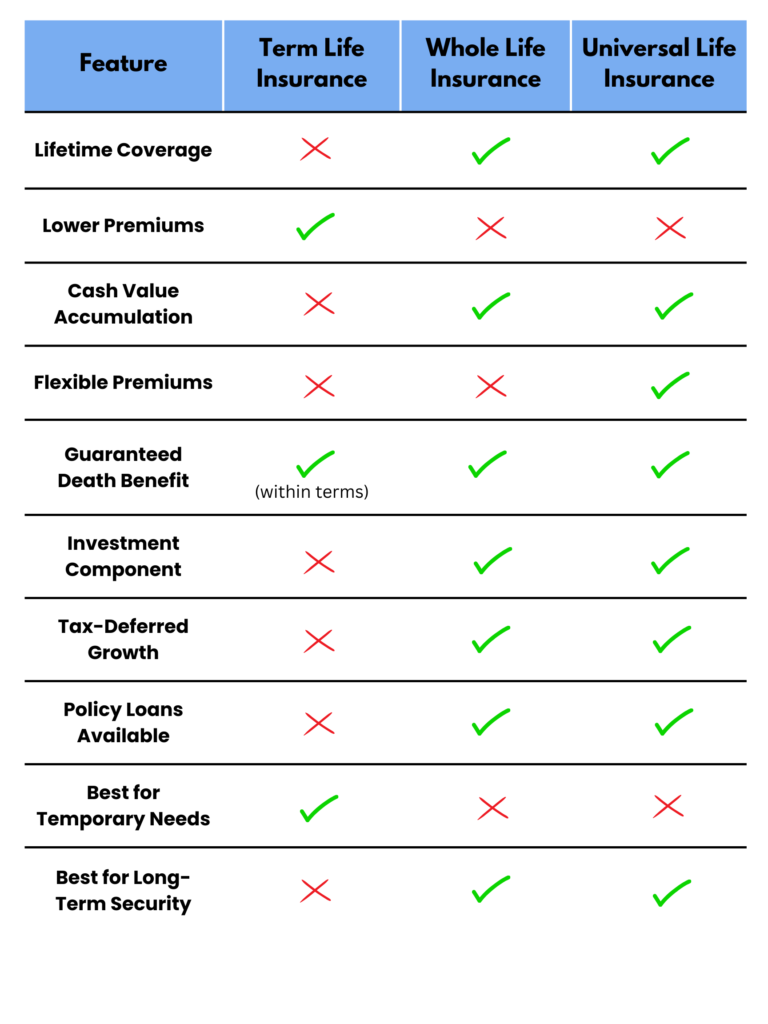

Types of Life Insurance Policies

Life insurance isn’t one-size-fits-all, and the type of policy you choose depends on your needs, financial situation, and long-term goals. Here’s a breakdown of the most common types of life insurance:

1. Term Life Insurance

Term life insurance is the most straightforward and affordable type of policy. It provides coverage for a specific period (or term), usually 10, 20, or 30 years. If you pass away during the term, your beneficiaries receive the death benefit. If you outlive the policy, the coverage ends, and no payout is made.

Why consider it?

Term life insurance is ideal for those who need temporary coverage, such as young families looking to cover the cost of raising children or paying off a mortgage. It’s also the most cost-effective option, making it accessible for many.

Key Features

- Lower premiums compared to permanent life insurance.

- Flexibility to choose the term length based on your needs.

- No cash value accumulation.

2. Whole Life Insurance

Whole life insurance provides lifelong coverage. As long as you pay the premiums, the policy remains in force, and your beneficiaries receive the death benefit whenever you pass away. Additionally, whole life insurance policies have a cash value component that grows over time. This cash value can be borrowed against or withdrawn, offering financial flexibility during your lifetime.

Why consider it?

Whole life insurance is ideal for those who want lifelong protection and the added benefit of cash value accumulation. It’s a good option for individuals who want to leave a legacy or use the policy as part of their long-term financial strategy.

Key Features

- Lifelong coverage.

- Cash value grows over time and can be accessed if needed.

- Higher premiums compared to term life insurance.

3. Universal Life Insurance

Universal life insurance is another type of permanent life insurance that offers more flexibility than whole life. With universal life, you can adjust your premium payments and death benefit as your financial situation changes. Like whole life, it also accumulates cash value, which can be used to cover premium payments or for other financial needs.

Why consider it?

Universal life insurance is suitable for those who want permanent coverage but with the flexibility to adjust their policy as life changes, such as when children grow up or after retirement.

Key Features

- Flexibility to adjust premiums and death benefits.

- Lifelong coverage with cash value accumulation.

- Higher premiums but with more adaptability.

The Importance of Early Life Insurance Enrollment

One of the biggest advantages of getting life insurance early in life is cost savings. The younger and healthier you are, the lower your premiums will be. Locking in a policy at a young age can save you significant money over the life of the policy. Additionally, securing coverage early ensures you’re protected, even if your health declines later.

Other benefits of early enrollment include:

- Lower Premiums: Insurance companies charge lower premiums to younger, healthier applicants. If you wait until you’re older or develop health issues, your premiums will be higher—or you may not qualify for coverage at all.

- Guaranteed Coverage: Life is unpredictable. Securing coverage while you’re healthy guarantees that you’ll be protected no matter what health issues arise later.

- Cash Value Accumulation: For permanent policies, enrolling early allows more time for the cash value to grow, giving you a valuable asset that can be used for emergencies or even as retirement income.

Debunking Common Life Insurance Myths

There are many misconceptions surrounding life insurance, especially among younger adults. Let’s debunk some of the most common myths:

“I’m too young to need life insurance.”

The reality is that the younger you are, the cheaper life insurance is. Waiting until you’re older could cost you more in premiums or, worse, result in being uninsurable due to health issues.

“It’s too expensive.”

Many people overestimate the cost of life insurance. Term life insurance, in particular, is affordable and can fit into most budgets. Plus, the financial security it provides far outweighs the cost.

“I don’t have dependents, so I don’t need it.”

Even if you don’t have children, life insurance can cover funeral costs, pay off debts, or provide for a partner or other loved ones.

How to Choose the Right Life Insurance Policy

Choosing the right life insurance policy involves evaluating your current financial situation, long-term goals, and the needs of your loved ones. Here are some tips to help you make an informed decision:

1. Assess Your Needs

Determine how much coverage you need by considering factors like your income, debts, and future financial obligations (e.g., children’s education, mortgage). Use an online calculator or work with a financial advisor to pinpoint the right amount.

2. Choose the Right Type of Policy

Decide whether you need term or permanent life insurance based on your long-term goals. The term is best for temporary needs (like paying off a mortgage), while permanent policies are better for lifelong protection and estate planning.

3. Compare Quotes

Get quotes from multiple insurance providers to ensure you’re getting the best rate for the coverage you need.

4. Consider Riders

Life insurance riders allow you to customize your policy with additional coverage, like critical illness or disability insurance. These can provide extra protection if life throws unexpected challenges your way.

5. Review Your Policy Regularly

As your life changes, so should your life insurance. Major life events like marriage, the birth of a child, or buying a home may mean you need to adjust your coverage.

Conclusion

Life insurance is an essential part of any comprehensive financial plan. Whether you’re looking to protect your family, ensure your debts are covered, or leave behind a financial legacy, the right life insurance policy can provide the security you need. By understanding your options, starting early, and regularly reviewing your coverage, you can rest easy knowing your loved ones will be cared for, no matter what the future holds.

At Arth Wealth Solutions, we understand the importance of safeguarding your family’s future and helping you make the right decisions for your financial well-being. Our team is dedicated to guiding you through every step of your life insurance journey, ensuring that you select the perfect policy tailored to your unique needs. Whether you’re starting out or planning for your family’s long-term security, we’re here to provide expert advice and support.

Take the first step in securing your loved ones’ future by reaching out to Arth Wealth Solutions today—we’re ready to help you build a legacy of protection and peace of mind.